28+ rhode island tax calculator

The Rhode Island bonus tax. Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

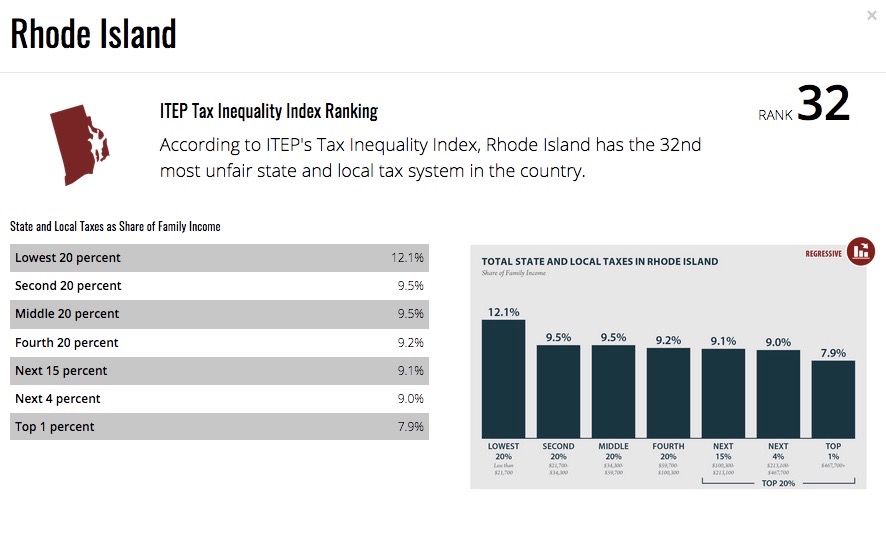

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest Uprise Ri

Web The Rhode Island tax is based on federal adjusted gross income subject to modification.

. Every 2023 combined rates mentioned above. Web The state general sales tax rate of Rhode Island is 7. Just enter the wages tax withholdings and other.

Web The Rhode Island State Tax calculator is updated to include. The latest Federal tax rates for 202324 tax year as published by the IRS. Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

Take the Assessed Value of the property then. Ad Find Recommended Rhode Island Tax Accountants Fast Free on Bark. Rhode Island cities andor municipalities dont have a city sales tax.

The calculator will show you the total sales tax amount as. The latest State tax rates for 202324 tax. The tax rates vary by income level but are the same for.

Web Rhode Island Income Tax Calculator 2022-2023 If you make 70000 a year living in Rhode Island you will be taxed 10281. Web This Rhode Island bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Your average tax rate is 2046 and.

Web The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. The current tax forms and tables should be consulted for the current rate. Web Rhode Island Income Tax Calculator 2021 If you make 201000 a year living in the region of Rhode Island USA you will be taxed 52374.

Web You can use our Rhode Island Sales Tax Calculator to look up sales tax rates in Rhode Island by address zip code. Your average tax rate is 1167 and your. Rhode Island has a progressive state income tax system with three tax brackets.

Web Overview of Rhode Island Taxes. Web The Rhode Island Tax Calculator Estimate Your Federal and Rhode Island Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household. Web Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax Rate1000 Rhode Island Property Tax.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

June 2016 Dc Beacon By The Beacon Newspapers Issuu

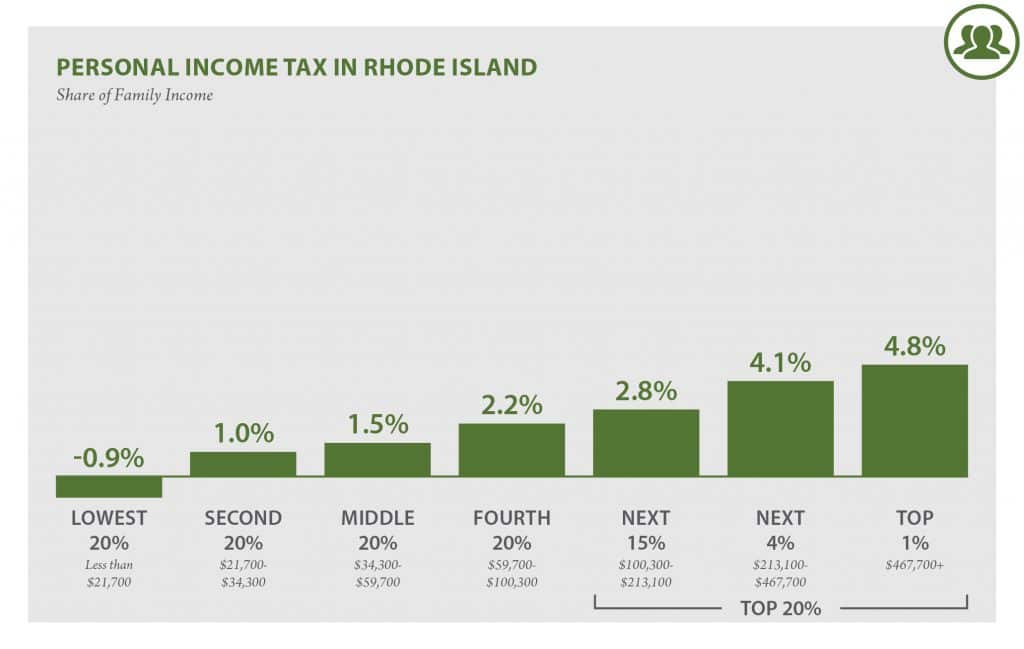

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent Uprise Ri

Member S Directory 1 Cs Pdf Delhi Sikhism

28 Flats Without Brokerage For Sale In Bommenahalli Bengaluru

This Tool Shows Where Digital Nomads Can Get Visas Andy Sto

Rhode Island Income Tax Ri State Tax Calculator Community Tax

November 2022 48 North Digital By 48 North Issuu

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Global Service Providers Guide 2022 By Chemical Watch Issuu

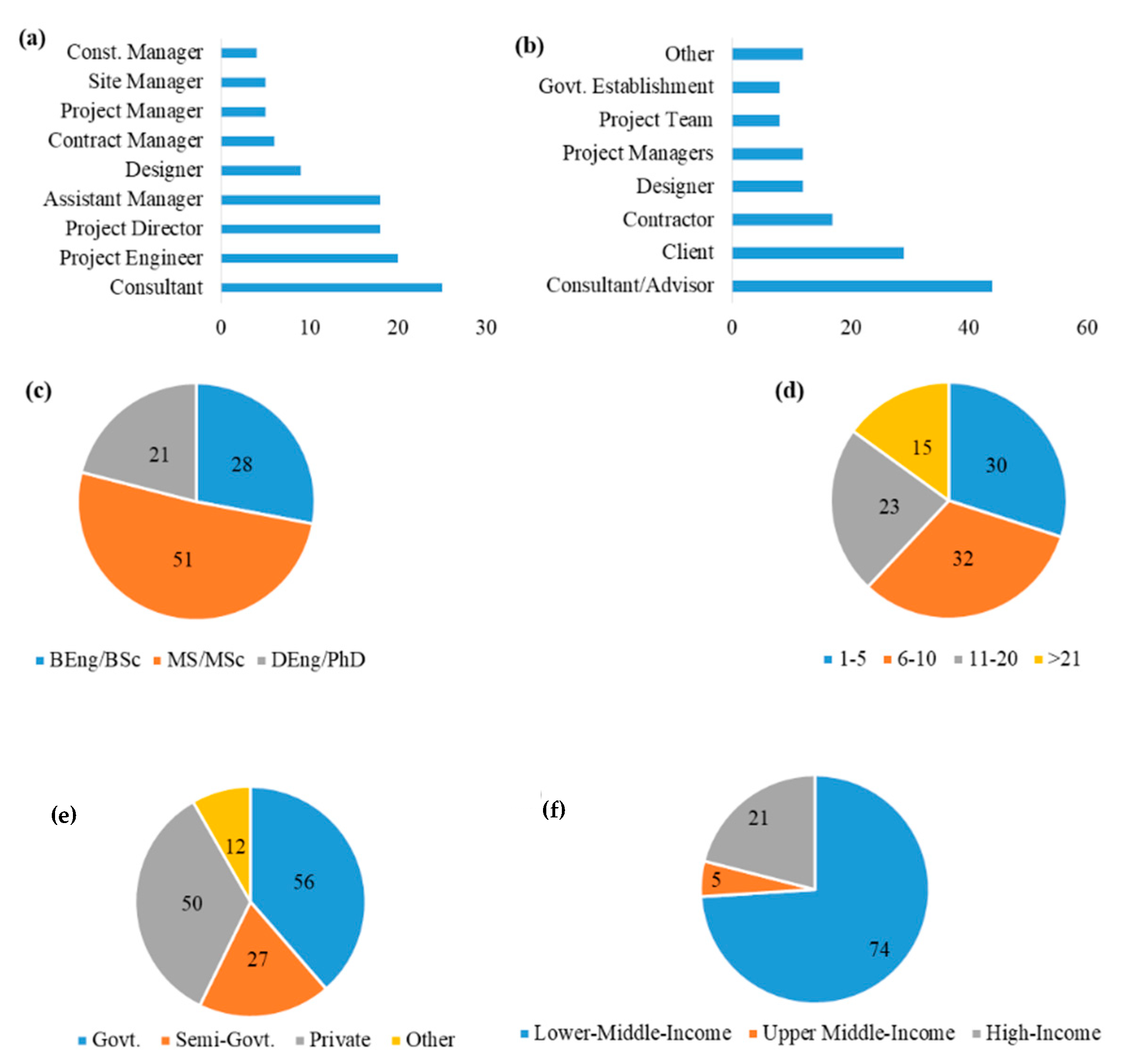

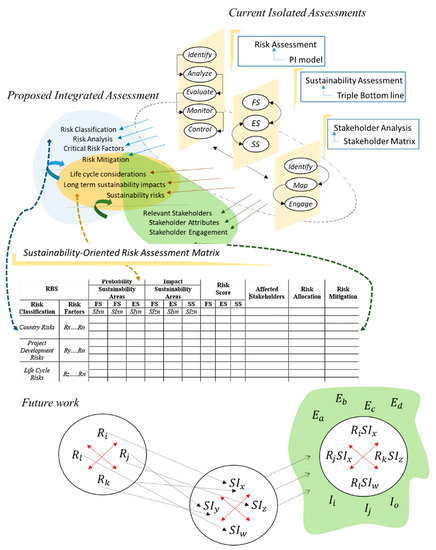

Sustainability Free Full Text A Sustainability Based Risk Assessment For P3 Projects Using A Simulation Approach

Sustainability Free Full Text A Sustainability Based Risk Assessment For P3 Projects Using A Simulation Approach

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest Uprise Ri

2590 Kauapea Road House For Sale In Kilauea 647366 Neal Norman Hawaii Life

Yes Tiverton S Property Taxes Are High Tiverton Fact Check

Rhode Island Income Tax Ri State Tax Calculator Community Tax